Download & Install

Darasa Huru App

DOWNLOAD

TOPIC 6: ELEMENTARY TRADING PROFIT AND LOSS ACCOUNT | B/KEEPING FORM 1

Final accounts give a concise idea about the profitability and financial position of a business to its management, owners, and other interested parties.

All business transactions are first recorded in a journal. They are then transferred to a ledger and balanced.

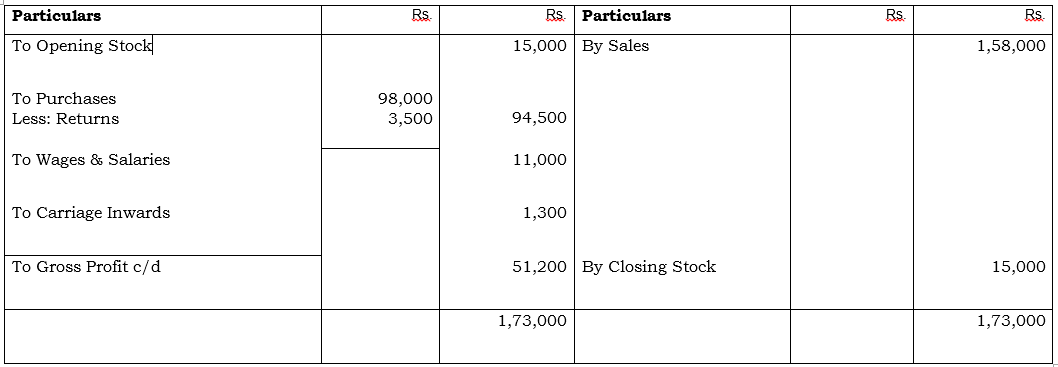

GROSS PROFIT=SALES-COST OF GOODS SOLD

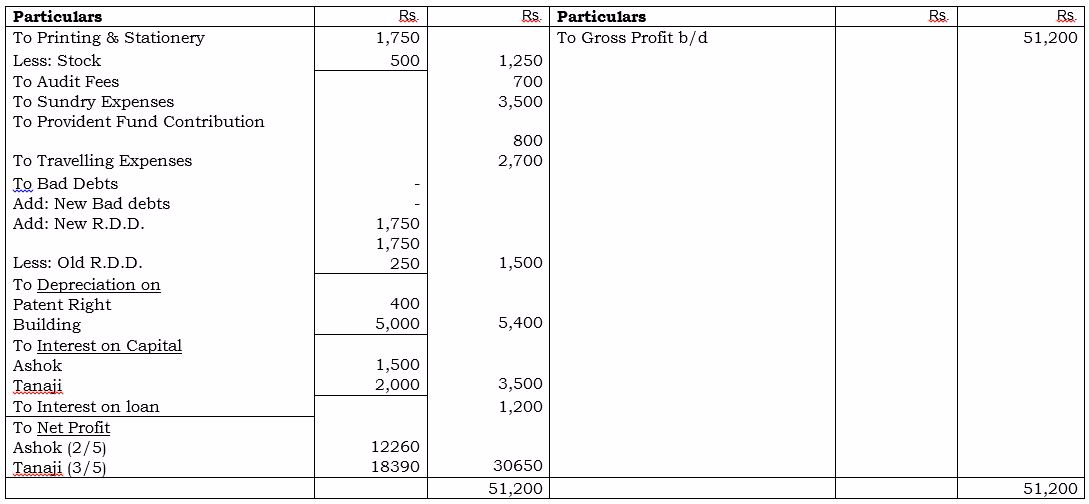

A profit and loss statement (P&L) is a financial statement that

summarizes the revenues, costs and expenses incurred during a specific

period of time, usually a fiscal quarter or year. These records provide

information about a company’s ability –or lack thereof –to generate

profit by increasing revenue, reducing costs, or both. The P&L

statement is also referred to as “statement of profit and loss”, “income

statement,” “statement of operations,” “statement of financial

results,” and “income and expense statement.”

EXAMPLE

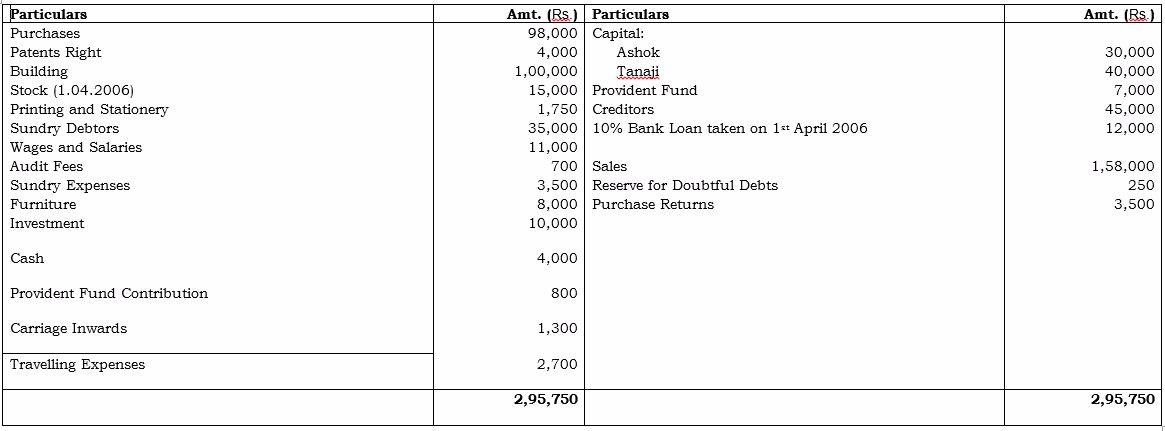

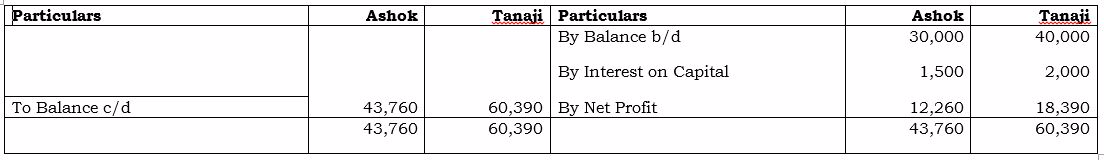

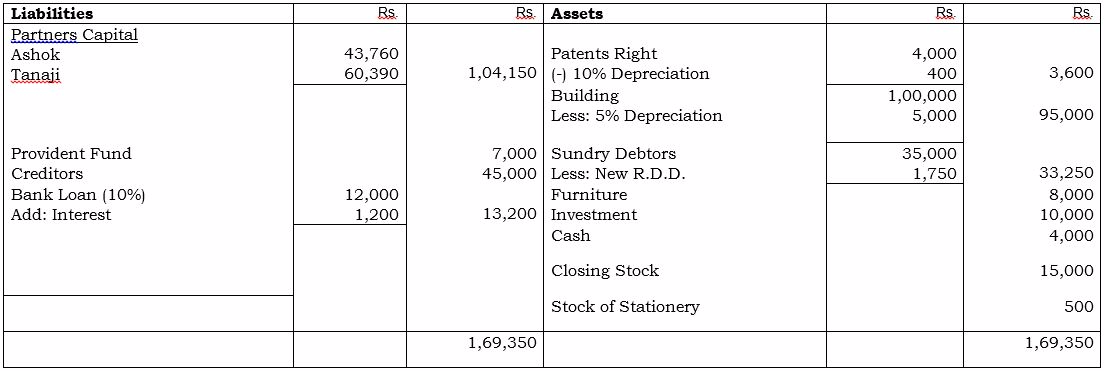

Ashok and Tanaji are Partners sharing Profit and Losses in the ratio 2:3 respectively. Their Trial Balance as on 31st March, 2007 is given below. You are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2007 and Balance Sheet as on that date after taking into account the given adjustments.

- Closing stock is valued at the cost of Rs. 15,000 while its market price is Rs.18,000.

- On 31st March, 2007 the stock of stationery was Rs. 500.

- Provide reserve for bad and doubtful debts at 5% on debtors.

- Depreciate building at 5% and patent rights at 10%.

- Interest on capitals is to be provided at 5% p.a

The Cost of Goods Sold

Determine the cost of goods sold

Activity 2

Determine the net profit and the net loss