Download & Install

Darasa Huru App

DOWNLOAD

TOPIC 3: CLASSIFICATION OF ACCOUNTS | B/KEEPING FORM 1

Classification of Accounts

- Personal accounts

- Impersonal

- Real accounts

- Tangible accounts

- Intangible accounts

Difference between Personal and Impersonal Account

Differentiate between personal and impersonal accounts

account related to any artificial person like M/s ABC Ltd, M/s General

Trading, M/s Reliance Industries, etc., is called as an Artificial Personal Account.

Representative

personal account represents a group of account. If there are a number

of accounts of similar nature, it is better to group them like salary

payable account, rent payable account, insurance prepaid account,

interest receivable account, capital account and drawing account, etc.

Identify the possessions of the business

Every

Business has some assets and every asset has an account. Thus, asset

account is called a real account. There are two type of assets:

- Tangible assets are touchable assets such as plant, machinery, furniture, stock, cash, etc

- Intangible assets are non-touchable assets such as goodwill, patent, copyrights, etc.

Nominal Accounts

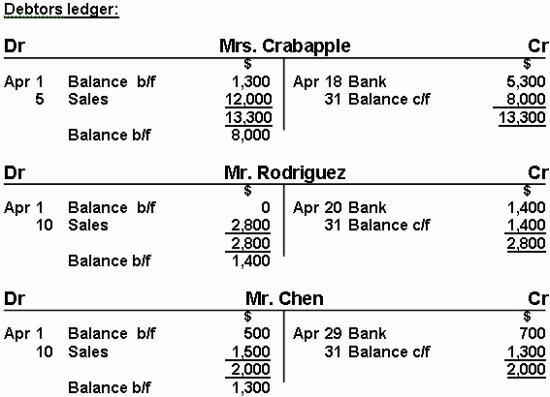

A debtor

is an entity or person that owes money to another party. Thus, there is

a creditor and a debtor in every lending arrangement. The relationship

between a debtor and a creditor is crucial to the extension of credit

between parties and the related transfer of assets and settlement of

liabilities.