Adjusting entries are accounting journal entries that convert a company’s accounting records to theaccrual basis of accounting.An adjusting journal entry is typically made just prior to issuing a company’sfinancial statements.

The Reasons Why the Life of a Business is divided into Accounting Period

Explain why the life of a business is divided into accounting period

An

accounting adjustment is a business transaction that has not yet been

included in the accounting records of a business as of a specific date.

Most transactions are eventually recorded through the recordation of

(for example) a supplier invoice, a customer billing, or the receipt of

cash. Such transactions are usually entered in a module of the

accounting software that is specifically designed for it, and which

generates an accounting entry on behalf of the user.

accounting adjustment is a business transaction that has not yet been

included in the accounting records of a business as of a specific date.

Most transactions are eventually recorded through the recordation of

(for example) a supplier invoice, a customer billing, or the receipt of

cash. Such transactions are usually entered in a module of the

accounting software that is specifically designed for it, and which

generates an accounting entry on behalf of the user.

However,

if such transactions have not yet been recorded as of the end of an

accounting period, or if the entry incorrectly states the impact of the

transaction, the accounting staff makes accounting adjustments in the

form of adjusting entries. These adjustments are designed to bring the

company’s reported financial results into compliance with the dictates

of the relevant accounting framework, such as Generally Accepted

Accounting Principles or International Financial Reporting Standards.

The adjustments are primarily used under the accrual basis of

accounting. Examples of such accounting adjustments are:

if such transactions have not yet been recorded as of the end of an

accounting period, or if the entry incorrectly states the impact of the

transaction, the accounting staff makes accounting adjustments in the

form of adjusting entries. These adjustments are designed to bring the

company’s reported financial results into compliance with the dictates

of the relevant accounting framework, such as Generally Accepted

Accounting Principles or International Financial Reporting Standards.

The adjustments are primarily used under the accrual basis of

accounting. Examples of such accounting adjustments are:

- Altering the amount in a reserve account, such as the allowance for doubtful accounts or the inventory obsolescence reserve.

- Recognizing revenue that has not yet been billed.

- Deferring the recognition of revenue that has been billed but has not yet been earned.

- Recognizing expenses for supplier invoices that have not yet been received.

- Deferring

the recognition of expenses that have been billed to the company, but

for which the company has not yet expended the asset. - Recognizing prepaid expenses as expenses.

The Reasons Why the Accounts must be Adjusted at the End of Each Accounting Period

State why the accounts must be adjusted at the end of each accounting period

Some

of these accounting adjustments are intended to be reversing entries –

that is, they are to be reversed as of the beginning of the next

accounting period. In particular, accrued revenue and expenses should be

reversed. Otherwise, inattention by the accounting staff may leave

these adjustments on the books in perpetuity, which may cause future

financial statements to be incorrect. Reversing entries can be set to

automatically reverse in a future period, thereby eliminating this risk.

of these accounting adjustments are intended to be reversing entries –

that is, they are to be reversed as of the beginning of the next

accounting period. In particular, accrued revenue and expenses should be

reversed. Otherwise, inattention by the accounting staff may leave

these adjustments on the books in perpetuity, which may cause future

financial statements to be incorrect. Reversing entries can be set to

automatically reverse in a future period, thereby eliminating this risk.

Accounting

adjustments can also apply to prior periods when the company has

adopted a change in accounting principle. When there is such a change,

it is carried back through earlier accounting periods, so that the

financial results for multiple periods will be comparable

adjustments can also apply to prior periods when the company has

adopted a change in accounting principle. When there is such a change,

it is carried back through earlier accounting periods, so that the

financial results for multiple periods will be comparable

How Adjusting Entries are Related to the Concept of Accrual Accounting and Matching Principle

Explain how adjusting entries are related to the concept of accrual accounting and matching principle

An

adjusting entry to accrue expenses is necessary when there are

unrecorded expenses and liabilities that apply to a given accounting

period. These expenses may include wages for work performed in the

current accounting period but not paid until the following accounting

period and also the accumulation of interest on notes payable and other

debts.

adjusting entry to accrue expenses is necessary when there are

unrecorded expenses and liabilities that apply to a given accounting

period. These expenses may include wages for work performed in the

current accounting period but not paid until the following accounting

period and also the accumulation of interest on notes payable and other

debts.

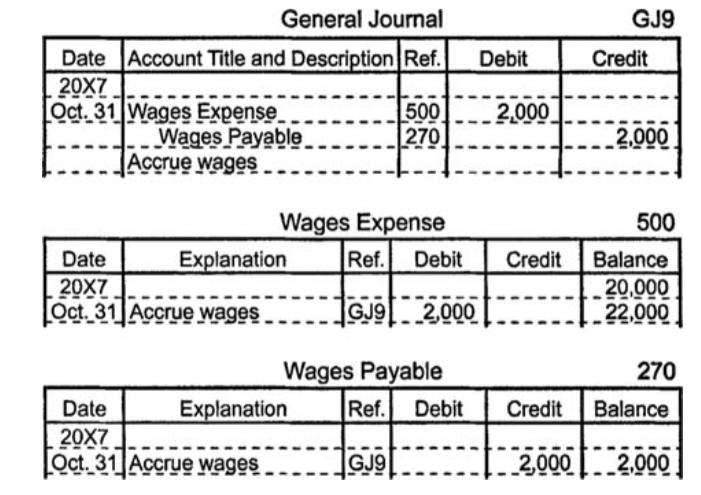

Suppose

a company owes its employees $2,000 in unpaid wages at the end of an

accounting period. The company makes an adjusting entry to accrue the

expense by increasing (debiting) wages expense for $2,000 and by

increasing (crediting) wages payable for $2,000.

a company owes its employees $2,000 in unpaid wages at the end of an

accounting period. The company makes an adjusting entry to accrue the

expense by increasing (debiting) wages expense for $2,000 and by

increasing (crediting) wages payable for $2,000.

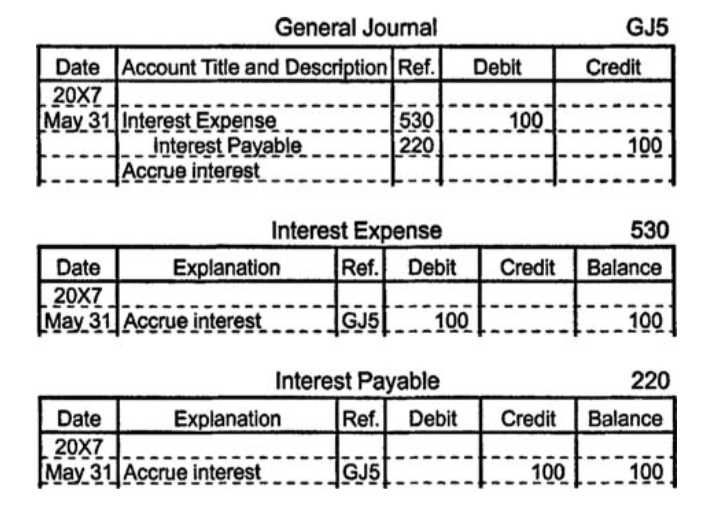

If

a long-term note payable of $10,000 carries an annual interest rate of

12%, then $1,200 in interest expense accrues each year. At the close of

each month, therefore, the company makes an adjusting entry to increase

(debit) interest expense for $100 and to increase (credit) interest

payable for $100.

a long-term note payable of $10,000 carries an annual interest rate of

12%, then $1,200 in interest expense accrues each year. At the close of

each month, therefore, the company makes an adjusting entry to increase

(debit) interest expense for $100 and to increase (credit) interest

payable for $100.

Accounting

records that do not include adjusting entries for accrued expenses

understate total liabilities and total expenses and overstate net

income.

records that do not include adjusting entries for accrued expenses

understate total liabilities and total expenses and overstate net

income.

The Four Basic Adjusting Entries

Describe the four basic adjusting retries

Basic types of adjusting journal entries:

- Accrued revenues(also

called accrued assets) are revenues already earned but not yet paid by

the customer or posted to the general ledger. An example of accrued

revenue would be for a custom ordered machine that has been shipped FOB

shipping point on the day the accounts receivable module is closed and

the approval to bill the customer has not been received by the billing

clerk. An adjusting entry would be recorded to recognize the revenue in

the correct period. This entry will reverse when the customer is

appropriately invoiced. Accrued Revenue 14,00; Revenue 14,000 - Unearned revenues(or

deferred revenues) are revenues received in cash and recorded as

liabilities prior to being earned. Unearned revenue is a liability to

the entity until the revenue is earned. An example of unearned revenue

would be if the customer paid a deposit for a custom ordered machine

that has not been delivered, the deposit would be recorded as unearned

revenue. This type of adjusting entry will be adjusted by another entry.

Revenue 14,000; Deferred Revenue 14,000 - Accrued expenses(also

called accrued liabilities) are expenses already incurred but not yet

paid or recorded. Examples of these types of adjusting entries could be

for payroll that has been earned by employees on the last day of the

period but not paid until the next payroll date. These types of entries

generally reverse the next month. Salaries Expense 89,000; Salaries

Payable 89,000 - Prepaid expenses(or deferred

expenses) are expenses paid in cash and recorded as assets prior to

being used. The most common form of an adjusting entry for prepaid

expense would be for the used portion of an insurance premium. These

types of adjusting entries are usually permanent. Insurance Expense

1,000; Prepaid Insurance 1,000 - Other adjusting entries includedepreciationof fixed assets, allowancesfor bad debts, and inventory adjustments. Bad Debt Expense 50; Allowance for Bad debt 50 (Adjusting EN, 2010)

At

the end of each closing period, usually monthly, a thorough analysis of

the trial balance is preformed. This analysis includes performance

budget to actual and month to month to ensure all of the accounts are

correctly stated. When an adjusting entry is identified, a journal entry

input form is prepared. This form should be supported with source

documents that justify the entry and reviewed and approved by the

appropriate level of accounting management. Once the approval has been

obtained, the journal entry is keyed into the general ledger system as

either a standard or self reversing journal entry. The journal entry is

then posted to the general ledger.

the end of each closing period, usually monthly, a thorough analysis of

the trial balance is preformed. This analysis includes performance

budget to actual and month to month to ensure all of the accounts are

correctly stated. When an adjusting entry is identified, a journal entry

input form is prepared. This form should be supported with source

documents that justify the entry and reviewed and approved by the

appropriate level of accounting management. Once the approval has been

obtained, the journal entry is keyed into the general ledger system as

either a standard or self reversing journal entry. The journal entry is

then posted to the general ledger.

Preparation of Adjusting Entries for Prepaid Expenses, Unearned Revenue, Accrued Revenues and Depreciation

Prepare adjusting entries for prepaid expenses, unearned revenue, accrued Revenues and depreciation

Prepaid

expenses are assets that become expenses as they expire or get used up.

For example, office supplies are considered an asset until they are

used in the course of doing business, at which time they become an

expense. At the end of each accounting period, adjusting entries are

necessary to recognize the portion of prepaid expenses that have become

actual expenses through use or the passage of time.

expenses are assets that become expenses as they expire or get used up.

For example, office supplies are considered an asset until they are

used in the course of doing business, at which time they become an

expense. At the end of each accounting period, adjusting entries are

necessary to recognize the portion of prepaid expenses that have become

actual expenses through use or the passage of time.

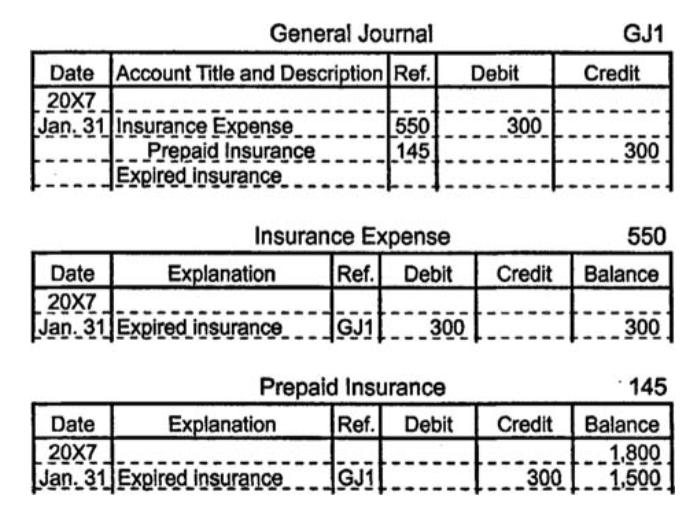

Consider

the previous example from the point of view of the customer who pays

$1,800 for six months of insurance coverage. Initially, she records the

transaction by increasing one asset account (prepaid insurance) with a

debit and by decreasing another asset account (cash) with a credit.

After one month, she makes an adjusting entry to increase (debit)

insurance expense for $300 and to decrease (credit) prepaid insurance

for $300.

the previous example from the point of view of the customer who pays

$1,800 for six months of insurance coverage. Initially, she records the

transaction by increasing one asset account (prepaid insurance) with a

debit and by decreasing another asset account (cash) with a credit.

After one month, she makes an adjusting entry to increase (debit)

insurance expense for $300 and to decrease (credit) prepaid insurance

for $300.

Prepaid

expenses in one company’s accounting records are often—but not always—

unearned revenues in another company’s accounting records. Office

supplies provide an example of a prepaid expense that does not appear on

another company’s books as unearned revenue.

expenses in one company’s accounting records are often—but not always—

unearned revenues in another company’s accounting records. Office

supplies provide an example of a prepaid expense that does not appear on

another company’s books as unearned revenue.

Accounting

records that do not include adjusting entries to show the expiration or

consumption of prepaid expenses overstate assets and net income and

understate expenses.

records that do not include adjusting entries to show the expiration or

consumption of prepaid expenses overstate assets and net income and

understate expenses.

Preparation of Entries to Dispose of Accrued Revenue and Expense Items in Three New Accounting Period

Prepare entries to dispose of accrued revenue and expense items in thee new accounting period

Accrued

income is an amount earned but not actually received during the

accounting period or till the date of preparation of Final Accounts for

the period concerned. Such an income receivable is also called income

earned but not received or income accrued or income due and outstanding.

income is an amount earned but not actually received during the

accounting period or till the date of preparation of Final Accounts for

the period concerned. Such an income receivable is also called income

earned but not received or income accrued or income due and outstanding.

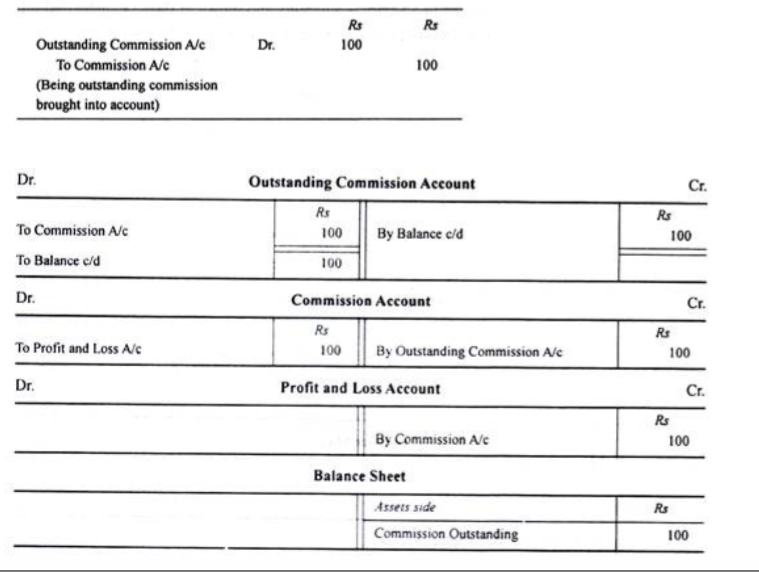

For

instance, interest on investments, rent from sub-letting, commission on

sales etc., earned by the business during a particular accounting

period but might not have been received so far. Thus such outstanding

income needs adjustment when Final Accounts are prepared. For instance,

commission has been earned but not received Rs 100.

instance, interest on investments, rent from sub-letting, commission on

sales etc., earned by the business during a particular accounting

period but might not have been received so far. Thus such outstanding

income needs adjustment when Final Accounts are prepared. For instance,

commission has been earned but not received Rs 100.

The double effect of accrued income is:

- It is credited to the Profit & Loss Account

- It is shown in the asset side of the Balance Sheet. Income Received in Advance: Adjustment Entries in Final Accounts!

Income

received during a particular trading period for the work to be done in

future is termed as unearned income. When income is received in advance,

for the work not done yet, the trader is liable that is such income

though received is not the income for the current trading period, but

services will be rendered in the next year.

received during a particular trading period for the work to be done in

future is termed as unearned income. When income is received in advance,

for the work not done yet, the trader is liable that is such income

though received is not the income for the current trading period, but

services will be rendered in the next year.

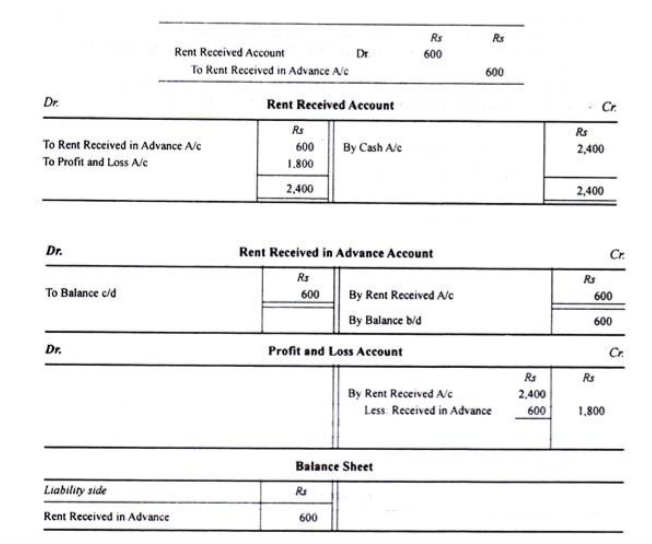

The

unearned income is deducted from the concerned income, in the credit

side of Profit and Loss Account and also shown in the liability side of

the Balance Sheet. For insurance, a trade received rent @ Rs 200 per

month for a full year ending on 31st March 2005 but his Final Accounts

are prepared for the year ending on 31st December 2004.

unearned income is deducted from the concerned income, in the credit

side of Profit and Loss Account and also shown in the liability side of

the Balance Sheet. For insurance, a trade received rent @ Rs 200 per

month for a full year ending on 31st March 2005 but his Final Accounts

are prepared for the year ending on 31st December 2004.

Then, the entries are:

The double effect in the Final Account is:

- The unearned income is deducted from Rent Received Account.

- The deducted amount is shown in the liability side of the Balance Sheet

Example 1

Ashok

and Tanaji are Partners sharing Profit and Losses in the ratio 2:3

respectively. Their Trial Balance as on 31st March, 2007 is given below.

You are required to prepare Trading and Profit and Loss Account for the

year ended 31stMarch, 2007 and Balance Sheet as on that date after

taking into account given adjustments.

and Tanaji are Partners sharing Profit and Losses in the ratio 2:3

respectively. Their Trial Balance as on 31st March, 2007 is given below.

You are required to prepare Trading and Profit and Loss Account for the

year ended 31stMarch, 2007 and Balance Sheet as on that date after

taking into account given adjustments.

| Particulars | Amt. (Rs.) | Particulars | Amt. (Rs.) |

| PurchasesPatents RightBuilding | 98,0004,0001,00,000 | Capital: Ashok Tanaji | 30,00040,000 |

| Stock (1.04.2006) | 15,000 | Provident Fund | 7,000 |

| Printing and Stationery | 1,750 | Creditors | 45,000 |

| Sundry Debtors Wages and Salaries | 35,00011,000 | 10% Bank Loan taken on 1st April 2006 | 12,000 |

| Audit Fees | 700 | Sales | 1,58,000 |

| Sundry Expenses | 3,500 | Reserve for Doubtful Debts | 250 |

| Furniture | 8,000 | Purchase Returns | 3,500 |

| Investment | 10,000 | ||

| Cash | 4,000 | ||

| Provident Fund Contribution | 800 | ||

| Carriage Inwards | 1,300 | ||

| Travelling Expenses | 2,700 | ||

| 2,95,750 | 2,95,750 |

Adjustments:

Activity 1

- Closing stock is valued at the cost of Rs. 15,000 while its market price is Rs.18,000.

- On 31st March, 2007 the stock of stationery was Rs. 500.

- Provide reserve for bad and doubtful debts at 5% on debtors.

- Depreciate building at 5% and patent rights at 10%. p.a.

- Interest on capitals is to be provided at 5%

Difference between the Cash and Accrual Basis of Accounting

Explain the difference between the cash and accrual basis of accounting

Under the cash basis of accounting

- Revenuesare reported on theincome statementin the period in which the cash is received from customers.

- Expensesare reported on the income statement when the cash is paid out.

Under theaccrual basis of accounting.

- Revenues are reported on the income statement when they areearned—which often occurs before the cash is received from the customers.

- Expenses

are reported on the income statement in the period when they occur or

when they expire—which is often in a period different from when the

payment is made.

The

accrual basis of accounting provides a better picture of a company’s

profits during anaccounting period. The reason is that the income

statement prepared under the accrual basis will report all of the

revenues actuallyearnedduring the period and all of the expenses incurred in order to earn the revenues.

accrual basis of accounting provides a better picture of a company’s

profits during anaccounting period. The reason is that the income

statement prepared under the accrual basis will report all of the

revenues actuallyearnedduring the period and all of the expenses incurred in order to earn the revenues.

The

accrual basis of accounting also provides a better picture of a

company’s financial position at a moment or point in time. The reason is

that all assets that were earned are reported and allliabilitiesthat

were incurred will be reported.

accrual basis of accounting also provides a better picture of a

company’s financial position at a moment or point in time. The reason is

that all assets that were earned are reported and allliabilitiesthat

were incurred will be reported.

The accrual basis of accounting is required because of the matching principle.

Importance of Comparability in the Financial Statements of a Business, Period after Period

Explain the importance of comparability in the financial statements of a business, period after period

Comparability

is one of the key qualities which accounting information must possess.

Accounting information is comparable when accounting standards and

policies are applied consistently from one period to another and from

one region to another. The characteristic of comparability offinancial

statementsis important because it allows us to compare a set of

financial statements with those of prior periods and those of other

companies.

is one of the key qualities which accounting information must possess.

Accounting information is comparable when accounting standards and

policies are applied consistently from one period to another and from

one region to another. The characteristic of comparability offinancial

statementsis important because it allows us to compare a set of

financial statements with those of prior periods and those of other

companies.

For example

- We

can compare 20X2 financial statements of ExxonMobil with its 20X1

financial statements to know whether performance and position improved

or deteriorated. - We can compare the ExxonMobil financial

statements with that of BP if both are prepared in accordance with same

set of accounting standards, such as IFRS or US GAAP, etc. - When

preparing 20X3 financial statements we are required to present with each

of the 20X3 figure the corresponding 20X2 figures. This is done to add

the characteristic of comparability to the financial statements.

Accounting

standards are intended to outline the best accounting treatment so that

companies follow them and hence accounting information

isunderstandable,relevant and reliableand comparable.Consistencymeans

that the accounting policies should be changed only when there are valid

grounds for such a change.

standards are intended to outline the best accounting treatment so that

companies follow them and hence accounting information

isunderstandable,relevant and reliableand comparable.Consistencymeans

that the accounting policies should be changed only when there are valid

grounds for such a change.

How the Realization Principle and the Matching Principle Attribute to Comparability

Explain how the realization principle and the matching principle attribute to comparability

Realization

concept in accounting, also known as revenue recognition principle,

refers to the application of accruals concept towards the recognition of

revenue (income).Under this principle, revenue is recognized by the

seller when it is earned irrespective of whether cash from the

transaction has been received or not.

concept in accounting, also known as revenue recognition principle,

refers to the application of accruals concept towards the recognition of

revenue (income).Under this principle, revenue is recognized by the

seller when it is earned irrespective of whether cash from the

transaction has been received or not.

In

case of sale of goods, revenue must be recognized when the seller

transfers the risks and rewards associated with the ownership of the

goods to the buyer. This is generally deemed to occur when the goods are

actually transferred to the buyer. Where goods are sold on credit

terms, revenue is recognized along with a corresponding receivable which

is subsequently settled upon the receipt of the due amount from the

customer.

case of sale of goods, revenue must be recognized when the seller

transfers the risks and rewards associated with the ownership of the

goods to the buyer. This is generally deemed to occur when the goods are

actually transferred to the buyer. Where goods are sold on credit

terms, revenue is recognized along with a corresponding receivable which

is subsequently settled upon the receipt of the due amount from the

customer.

Example 2

Motors

PLC is a car dealer. It receives orders from customers in advance

against 20% down payment. Motors PLC delivers the cars to the respective

customers within 30 days upon which it receives the remaining 80% of

the list price

PLC is a car dealer. It receives orders from customers in advance

against 20% down payment. Motors PLC delivers the cars to the respective

customers within 30 days upon which it receives the remaining 80% of

the list price

In

accordance with the revenue realization principle, Motors PLC must not

recognize any revenue until the cars are delivered to the respective

customers as that is the point when the risks and rewards incidental to

the ownership of the cars are transferred to the buyers.

accordance with the revenue realization principle, Motors PLC must not

recognize any revenue until the cars are delivered to the respective

customers as that is the point when the risks and rewards incidental to

the ownership of the cars are transferred to the buyers.

Application

of the realization principle ensures that the reported performance of

an entity, as evidenced from the income statement, reflects the true

extent of revenue earned during a period rather than the cash inflows

generated during a period which can otherwise be gauged from the cash

flow statement. Recognition of revenue on cash basis may not present a

consistent basis for evaluating the performance of a company over

several accounting periods due to the potential volatility in cash

flows.

of the realization principle ensures that the reported performance of

an entity, as evidenced from the income statement, reflects the true

extent of revenue earned during a period rather than the cash inflows

generated during a period which can otherwise be gauged from the cash

flow statement. Recognition of revenue on cash basis may not present a

consistent basis for evaluating the performance of a company over

several accounting periods due to the potential volatility in cash

flows.

Matching Principle

requires that expenses incurred by an organization must be charged to

the income statement in the accounting period in which the revenue, to

which those expenses relate, is earned.

requires that expenses incurred by an organization must be charged to

the income statement in the accounting period in which the revenue, to

which those expenses relate, is earned.

Prior

to the application of the matching principle, expenses were charged to

the income statement in the accounting period in which they were paid

irrespective of whether they relate to the revenue earned during that

period. This resulted in non recognition of expenses incurred but not

paid for during an accounting period (i.e. accrued expenses) and the

charge to income statement of expenses paid in respect of future periods

(i.e. prepaid expenses). Application of matching principle results in

the deferral of prepaid expenses in order to match them with the revenue

earned in future periods. Similarly, accrued expenses are charged in

the income statement in which they are incurred to match them with the

current period’s revenue.

to the application of the matching principle, expenses were charged to

the income statement in the accounting period in which they were paid

irrespective of whether they relate to the revenue earned during that

period. This resulted in non recognition of expenses incurred but not

paid for during an accounting period (i.e. accrued expenses) and the

charge to income statement of expenses paid in respect of future periods

(i.e. prepaid expenses). Application of matching principle results in

the deferral of prepaid expenses in order to match them with the revenue

earned in future periods. Similarly, accrued expenses are charged in

the income statement in which they are incurred to match them with the

current period’s revenue.

A

major development from the application of matching principle is the use

of depreciation in the accounting for non-current assets. Depreciation

results in a systematic charge of the cost of a fixed asset to the

income statement over several accounting periods spanning the asset’s

useful life during which it is expected to generate economic benefits

for the entity. Depreciation ensures that the cost of fixed assets is

not charged to the profit & loss at once but is ‘matched’ against

economic benefits (revenue or cost savings) earned from the asset’s use

over several accounting periods.

major development from the application of matching principle is the use

of depreciation in the accounting for non-current assets. Depreciation

results in a systematic charge of the cost of a fixed asset to the

income statement over several accounting periods spanning the asset’s

useful life during which it is expected to generate economic benefits

for the entity. Depreciation ensures that the cost of fixed assets is

not charged to the profit & loss at once but is ‘matched’ against

economic benefits (revenue or cost savings) earned from the asset’s use

over several accounting periods.

Matching

principle therefore results in the presentation of a more balanced and

consistent view of the financial performance of an organization than

would result from the use of cash basis of accounting.

principle therefore results in the presentation of a more balanced and

consistent view of the financial performance of an organization than

would result from the use of cash basis of accounting.

Im obliged for the blog post. Really looking forward to read more. Really Cool.

I used to be able to find good information from your content.

I loved your article post. Keep writing.

Everything is very open with a very clear description of the issues. It was truly informative. Your website is useful. Thank you for sharing.